Adaptive AI Agents & Bots: The New Frontier of Cryptocurrency Trading

Introduction

Think of the early days of frozen food, which was available but not particularly good. That’s how cryptocurrency trading once felt before AI’s modern breakthroughs. Today, AI doesn’t just resemble a high-tech weather station. It’s more like a full-fledged forecasting network, scanning social buzz, macroeconomic shifts, on-chain movements, and nuanced sentiment. Recent breakthroughs in AI from ensemble models and LLM-powered agents to real-time adaptive bots are democratizing smart, strategy-driven trading.

What's New in AI-Powered Crypto Strategies (2025)

Advanced Neural Systems & Multi-Timeframe Models

In August 2025, a new paper presents neural network systems combining multi-timeframe analysis with high-frequency orderbook signals. These models synthesize market, on-chain, and orderbook data into unified “buy/sell pressure” signals, achieving sub-second decision-making with positive risk-adjusted returns.

LLM-Based Trading Agents

College-level researchers recently introduced MountainLion, a multi-agent LLM system that processes news, charts, and trading signals while offering interpretability and interactive strategy refinements. It continuously reflects on outcomes and refines recommendations in real-time, melding tech insight with trader intuition.

Scalable Ensemble Models

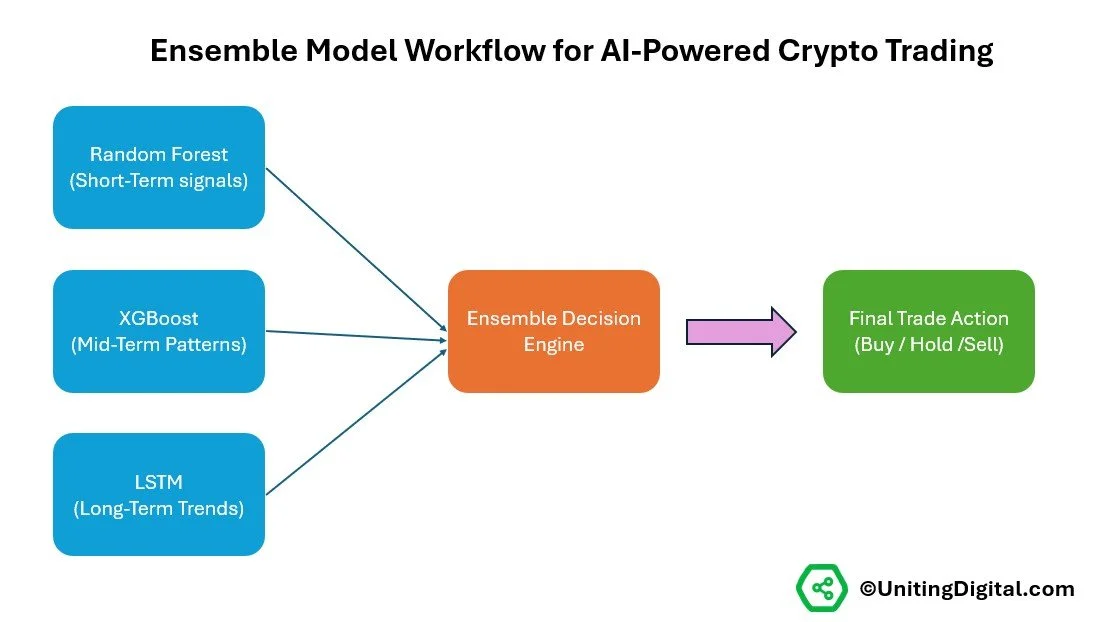

Ensemble models are like forming a trading committee instead of relying on a single “star” algorithm. Multiple models each with its own strengths are trained separately and then combined so their collective “vote” or averaged predictions guide trades. This reduces errors, improves accuracy, and makes the system more resilient to sudden market changes. In crypto trading, an ensemble might blend short-term predictors like XGBoost, medium-term decision trees, and long-term neural networks (LSTM) into one unified decision engine.

A recent study showcased ensembles trained via massive GPU-parallel simulations—speeding up sampling rates by up to 1,746× and lowering drawdowns while boosting Sharpe ratios noticeably.

Ensemble Model Workflow for AI-Powered Crypto Trading

Real-World Innovations & Tools

AI Trading Bots Are Everywhere

AI-powered bots now dominate by adapting to spot and futures markets in real time, unlike old rule-based alternatives.

Top platforms (3Commas, Cryptohopper, Pionex, Coinrule, Hummingbot) offer AI features, strategy marketplaces, copy-trading, and no-code automation across major exchanges.

Backtesting, APIs & Open-Source Frameworks

Demand is soaring for advanced backtesting tools, APIs (e.g., CoinGecko, Kaiko), and libraries like Backtrader and CCXT. These tools enable traders to fine-tune their strategies using predictive analytics and hyperparameter tuning.

AI in Crypto Tokenization & Institutional Moves

“AI tokens” are gaining traction, with a stunning $10 billion surge in market cap over just one week and some assets doubling in price.

Retail platforms like eToro are embedding AI-powered trading tools, expanding tokenized stocks, and riding a wave of growing crypto trading revenue.

On the M&A front, Kraken used generative AI (Termina) to shrink due diligence from weeks to hours in its $1.5 billion NinjaTrader acquisition.

Meanwhile, Google is testing a revamped Finance platform with AI chatbots, real-time charts, and crypto data—making smarter market monitoring more accessible to everyone.

AI Tokens Explained

AI tokens are cryptocurrencies tied to AI-powered platforms, tools, or ecosystems. They work like the “fuel” or “membership key” for accessing AI services that run on blockchain infrastructure.

Unlike a purely stablecoin such as DAI—which is pegged to the US dollar and designed for price stability—AI tokens usually have variable market value and are tied to the utility, governance, or rewards system of a specific AI project.

They can be:

Utility tokens – Needed to pay for AI services, API calls, or model training time.

Governance tokens – Let holders vote on AI model upgrades, pricing, or platform rules.

Reward tokens – Distributed to users who contribute data, train models, or improve the platform.

Examples:

Fetch.ai (FET) – Decentralized AI agents for automated tasks.

Ocean Protocol (OCEAN) – Data marketplace for AI model training.

SingularityNET (AGIX) – Marketplace for AI algorithms and services.

Numeraire (NMR) – AI-powered hedge fund platform for predictive trading models.

Why They’re Different from DAI:

DAI = Stablecoin pegged to $1, used as a stable payment unit across DeFi.

AI Token = Often volatile, represents access or participation in a specific AI-powered ecosystem. Value depends on the project’s adoption, not a peg to fiat.

Why They Matter in AI-Driven Crypto Trading:

You can trade them like any crypto asset, but they also give you functional access to AI-powered tools that might help in trading itself.

They bridge two hot sectors—AI and blockchain—making them attractive to both tech enthusiasts and speculators.

Some AI trading bots and platforms now accept their own tokens as payment, adding demand pressure when usage grows.

Why This Matters for You

Whether you're just starting out or managing complex portfolios, AI-driven tools today deliver:

Speed + Precision: Neural systems, ensemble strategies, and LLM agents make faster, smarter decisions—interpreting complex signals instantly.

Customization & Transparency: From ensemble models to interactive AI agents like MountainLion, you can shape strategies and understand the reasoning behind trade suggestions.

Democratized Access: No-code platforms, backtesting APIs, and AI token exposure open doors wider than ever before.

Things to Watch (and Watch Out For)

Overfitting Risks: Even powerful models can fail in new market conditions—ensemble testing and strategy diversification are your defense.

Data Bias & Interpretability: LLM agents reduce black-box risks, but biases still lurk—interpretability tools help guard against flawed signals.

Security & Cost: Bots require a secure API setup. Premium AI trading platforms may come with significant fees, so compare the costs carefully against the advantages.

AI Token Volatility: High upside, high risk—understand tokenomics and audit status (e.g., Certik) before diving in.

Takeaways & Getting Started

Retail Traders: Try platforms like Cryptohopper or 3Commas for AI-enabled bots, start with small positions, and backtest using open-source tools.

Advanced Users: Explore ensemble strategies on GPUs or experiment with multi-agent systems (MountainLion-style) for deeper, customizable models.

Investors Looking to Diversify: AI tokens present high-growth avenues, research thoroughly and understand their utility and sustainability.

Conclusion

AI isn't just a helpful assistant for crypto trading—it’s becoming the smart engine behind strategy, speed, and agility. From multi-timeframe neural systems to interpretable LLM agents, and from ensemble decision models to AI-powered products and tokens, we're in a new era. Smart adaptation, diversified strategies, and vigilance will help you ride this exciting wave, whether you're exploring, investing, or building the next-gen AI trading engine.

About the Author

Arthur Wang